A SKEPTICAL LOOK AT MOTORCYCLE INSURANCE

Insurance is Expensive and Confusing. But You Can Steer a Line Between Too Much and Not Enough.

Fred Gregory

Seven years ago, when I first began riding motorcycles, I went about it with as much logic as I could muster. I sought the advice of friends who were experienced riders. I perused road tests and how-to articles in the bike magazines. I shopped around, comparing prices and dealer services, and, ultimately, bought a Honda CB350. I settled on that particular bike because I wanted something that would haul me and a passenger around without rupturing itself, but wouldn’t be so muscular that I couldn’t keep it in hand. And, as I recall, I got a pretty good deal on it, somewhere around $550.

I took my time learning to ride, which I did without any strain or trauma. Looking back on it. I would recommend the same path for anyone contemplating motorcycling. That is. with one exception.

Having lived with cars most of my life. I was accustomed to—though never enthused or happy about—buying insurance. It has been, and continues to be. one of the great, frustrating, unpleasant hassles of life. Insuring my bike was worse.

Since I didn’t have a car at the time. I couldn't just tack on motorcycle insurance to my auto policy. I didn't know where to go. what agent to see. or what company to approach about motorcycle insurance. And I didn't want to spend the better part of a day going through the listings in the Yellow Pages. What I did do was ask a friend who was a long-time rider where he bought his insurance and simply went with his suggestion. I called his agent and bought a full-coverage policy for about $125 a year.

Then, after about two years with no claims against the company I figured that if 1 renewed my policy for another year. I would have put more money into buying insurance than my bike was worth.

After some thought. I decided to skip insurance altogether. It wasn’t a casual decision, but here was my situation; I was riding very little, about a thousand miles a year; my bike was securely garaged and when I did ride it. it was seldom out of my sight. I figured that the chances of the bike being stolen were slim, and if it were damaged, the repair costs would fall under the $100 deductible. I had health insurance through my job, so if I got hurt, that would be covered. It wasn't difficult rationalizing away that portion of my insurance. The liability portion was something else again; I decided to take a calculated risk. Seldom, if ever, did another person ride with me, as it turned out. And. I figured, if I did get into an accident, I would probably be on the receiving end anyway. I kept in mind the old maxim, “When you’re on a motorcycle, the bumpers are your knees.”

Eventually, I sold the 350 and bought a Honda CB550. which 1 still have. For the first year I had it, my riding situation remained the same, with the bike locked in the garage most of the time. But then, I found myself using it more and more, and insurance again became a problem for me. This time, I decided, I would find out what to do, where to go. and how to get the best coverage for the least money.

I immediately discovered that there are two nasty facts of life about owning and riding a motorcycle of which insurance companies are well aware—it is easier to get hurt on a motorcycle than on just about any other motorized transportation, and bikes are about as popular with thieves as small, unmarked bills. Insurance companies are not the civic-minded and public-spirited organizations they would like to have us believe they are. There's nothing they like more than profits or less than paying benefits. When it comes to bikes, the attitude among insurance companies appears to be that the latter is more likely than the former. For this reason, the major insurance companies—the ones with the familiar names who advertise widely and whose services are readily available—do not actively pursue the biker’s business. Many of these companies will not write you a motorcycle policy unless they cover your car or some other portion of your insurance business. And, their rates are not necessarily the best.

So where do you go if you're not already doing business with the “majors?”

I looked in the Yellow Pages. There were 30 pages listing every sort of company and agent in the Los Angeles area. There was not one ad with the word “motorcycle” in it, and in the individual tiny-type listings there was one (1) firm which proclaimed that it sold motorcycle insurance. Now, that is not to say that out of those hundreds of unfamiliar listings there were no other agents of firms that sold motorcycle insurance. The problem was to find which ones did, and of those, which had the best deal.

There’s no short cut to finding out who handles motorcycle insurance; you have to make the calls. But you can get quality coverage, through honest agents, from reliable companies. To find out what to get and how to do it, I spoke with numerous representatives of trade groups, insurance companies and consumer organizations. What I learned didn't make me sigh with relief, but it did make the chore of finding motorcycle insurance less of a gamble and, if not a great deal more pleasant, less frustrating.

I’ve already mentioned that the majors will normally take you only if you’re already covered under some other policy. There are, however, numerous other companies that specialize, to some degree, in insuring motorcycles (and we’ll speak of them later). But regardless of the company you ultimately choose, they all offer essentially the same kinds of coverage.

A typical so-called Full Coverage policy would cover liability, medical payments, uninsured motorist protection, towing and emergency road service, comprehensive and collision. To some extent, these can be bought in various combinations to suit your particular needs.

Liability coverage is the most important and, in some states, it is required by law. It pays for the damage you do to other’s bodies or property. Liability insurance protects your assets. Without it, in case of a judgment against you, you can lose your home, savings, possessions and a portion of your income. In short, you can be wiped out. According to the regulations of the state you live in, liability is available in a prescribed minimum amount. However, you can usually buy considerably more than the minimum for only a few dollars more. Considering the cost of medical care these days, this is a good idea.

Liability may not be necessary if the motorcycle you’re insuring is strictly an off-road machine. Theoretically, according to an insurance company official, there is no exposure to a liability claim with this kind of motorcycle. Some companies take this into consideration and offer special insurance packages for motorcycles used strictly for specific recreational purposes. Check with your agent.

Uninsured motorist coverage pays for damage to you or your motorcycle in case you tangle with—what else—an uninsured motorist. This is required in some states and is usually relatively cheap. When you consider that in some parts of the country one of three cars is uninsured, this can be a worthwhile investment.

Medical payment covers injuries you may sustain and may be dispensable if you are already protected by medical insurance or through a health plan where you work. You should check to see if your hospitalization covers you in case of an accident on your motorcycle. It generally will, but make sure there’s no small-print that excludes the possibility.

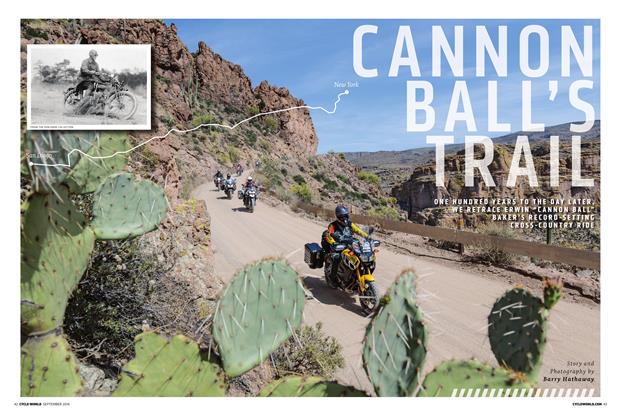

Towing and emergency road service may be useful to a rider who does considerable touring since it’s often difficult or impossible to make even the most elementary repairs to a motorcycle broken down alongside the road.

Now we come to comprehensive and collision, the most misunderstood and often the most easily eliminated types of coverage. Comprehensive insures you against fire, theft and a long list of improbable, though remotely possible, disasters. Collision pays for the damage caused to your bike if, say, you pile it into a tree.

If your motorcycle is being financed, you may not have any choice about whether or not you need this coverage. The people lending you the money don’t want anything to happen to their bike that won't be paid for. However, if you own your motorcycle free and clear, compare its market value against what you will be paying for comp and collision, then consider how much it would cost you to replace it after subtracting the deductible. Think about what the chances are of the bike being stolen. Mull it all over and ask yourself—is it worth it? It probably won’t be an easy decision to make, but a big hunk of your premium goes for comp and collision, and eliminating it is a sure way to save money.

You should also consider how other insurance you hold affects the ownership of your motorcycle. We’ve already seen that medical coverage may apply, but homeowner and household policies may also cover damage or loss of your bike while it’s on your property. By examining your various policies you can avoid overlapping coverage and paying twice for the same thing.

This is where an honest and consciencious agent can be handy. He can help you through the inpenetrable thickets of insurance policy jargon and perform any number of services. Finding such a paragon of the trade is another matter, however.

If you have other insurance and the guy who sold it to you has given you good service in the past, start with him. Otherwise, all you have to go by is the recommendations of friends, the word of your motorcycle dealer, or the Yellow Pages. It isn’t easy, but it’s worth it.

In any case, shop around. Rates vary and so do insurance companies. Odds are that unless you get your policy from the company that carries your car insurance, you will never have heard of the company that you ultimately buy your coverage from. How, in that event, can you tell if the company is reliable?

There are some guidelines to follow. The insurance business is regulated, so you have some protection. But you can also ask your agent some questions that he should be happy to answer. If he hedges, beware.

Ask how long this company has been in the motorcycle insurance business. It’s a tricky field and some companies, they’re > called “in-and-outers” by insurance men who have been handling motorcycles for some time, may try to break in by offering low premiums only to discover they’re losing money. Then, you may find yourself with a cancelled policy or refusal to renew.

Ask your agent if the company he represents will renew automatically (provided, of course, you don’t violate the stipulations of the policy).

Ask him how the company is rated. The Alfred M. Best company publishes ratings of insurance companies based on their assets, financial records and other criteria. The better companies have the higher ratings.

Ask him how many companies he represents. If it’s more than one, tell him you want to compare their premiums and their services.

Your agent, if he’s a good one, will probably tell you these things without your having to ask. Ideally, the company he recommends will satisfy the following criteria:

It should offer adequate protection at a price you can afford.

It should pay your claims promptly and adequately.

It should defend you against lawsuits.

It should not raise its rates arbitrarily or refuse to renew your policy unless you stop paying for it or lose your driving privilege.

There are, as far as I’ve been able to ascertain, only two large companies actively soliciting motorcycle insurance, Midwest Mutual and Universal Underwriters. They sell in most states. There are also companies with more regionalized markets. The things that they have in common is that they all sell essentially the same kinds of coverage and they’re handled by independent agents. In fact, one agent may represent several companies.

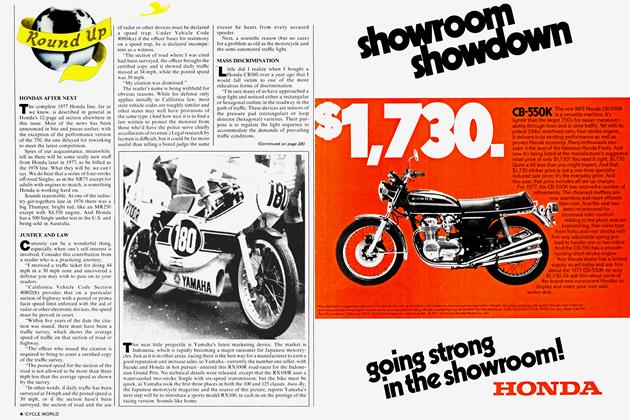

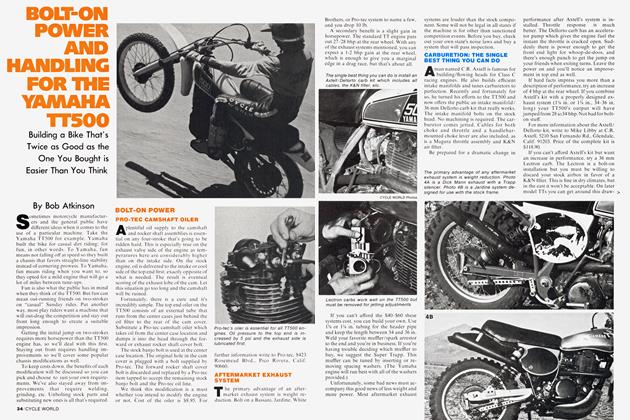

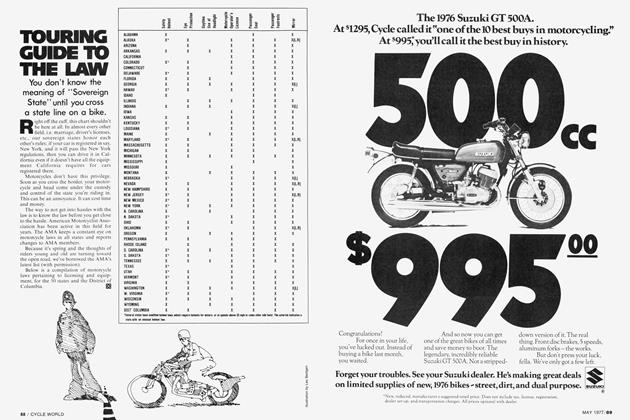

Though their rates will vary, they’re usually based on engine displacement. Some companies may use weight as a criteria, but the result is the same—the bigger the bike, the more expensive the insurance.

To give you an example, I asked one company their rates for a full coverage policy for various size motorcycles. These are for a rider living in Los Angeles w ho has at least a year of experience and wants to insure a new' motorcycle. For a 70cc bike the rate was $79; a 350 was $224; a 550, $300; a 750. $536; a 900. $689; and a lOOOcc was $765. By comparison, the same rates for a Kansas resident—lower because of a shorter riding season—were: $30 for the 70cc bike; $95 for the 350; $135 for the 550; $186 for the 750; $224 for the 900; and $241 for the lOOOcc bike.

As you can see, insurance is a significant chunk of the total cost of operating and owning a motorcycle. Much more so than with a car. And it really becomes astounding when you consider the premiums on the larger bikes. One person I spoke with told me that he pays as much to insure his Kawasaki Z as he does for a $30,000 Ferrari Daytona.

The reason is, according to insurance executives who bemoan the fact, the risk of covering a motorcycle is so great. The losses through injury claims or theft are large. “You’d be surprised at how much damage can happen to a bike just from its falling off’ a kick stand.” the president of one insurance company said. He added that in the case of theft, there was almost never a recovery, and that fraud is a constant problem.

Nobody is happy about the high prices. The insurance companies would just as soon cover more people for less and spread the risk around more. Dealers and manufacturers are concerned because they know that high rates deter people from buying motorcycles. And we all know how the consumer feels about it.

Unfortunately, there’s little good news forthcoming, though there are some attempts being made to ease the insurance burden on the motorcyclist. The American Motorcyclist Association has just established an insurance plan for its members in the hopes of getting more favorable rates through volume buying. The Motorcycle Safety Foundation has developed driver training courses similar to those offered car drivers in high school, and they are working with insurance companies to get reduced rates for graduates of the program. These are hopeful developments which may ultimately reduce the costs for all riders. But for the forseeable future, insuring a motorcycle is going to remain a costly proposition.

I ultimately resolved my insurance dilemma by foregoing all but liability coverage. It costs me $90 a year, and all I can do is hope nobody crashes into my bike or steals it. But. that’s the chance you take. IQ]

View Full Issue

View Full Issue