YOU MAY NOT HAVE IT IN THE DIRT

One of the men who works for this magazine rides off-road bikes and raises horses. He had a casual conversation with his insurance agent recently and came up with a surprising fact:

If his son is riding a horse around the neighborhood and wipes out the neighbor’s chickens or the artichoke harvest, the damage will be taken care of by the father’s homeowner policy.

If his son is riding a motorcycle around the neighborhood and wipes out chickens or artichokes or anything, the old man will pay out of his own pocket. Most homeowner policies in most states specifically exclude motor vehicles from insurance protecting the rest of your possessions.

Right at home, even. If somebody breaks into the place and makes off with the TV set, silverware, tools, etc., the homeowner’s policy covers the losses. If they take your bike, tough luck.

This came as a surprise to those of us who don’t pay much attention to the fine print.

Insurance men say that for their purposes, there are four kinds of motorcycles. There are road bikes, which are insured much the way cars are. There are dualpurpose bikes, which are not used on public roads only; there are playbikes, which aren't generally licensed, and there are purely competition bikes.

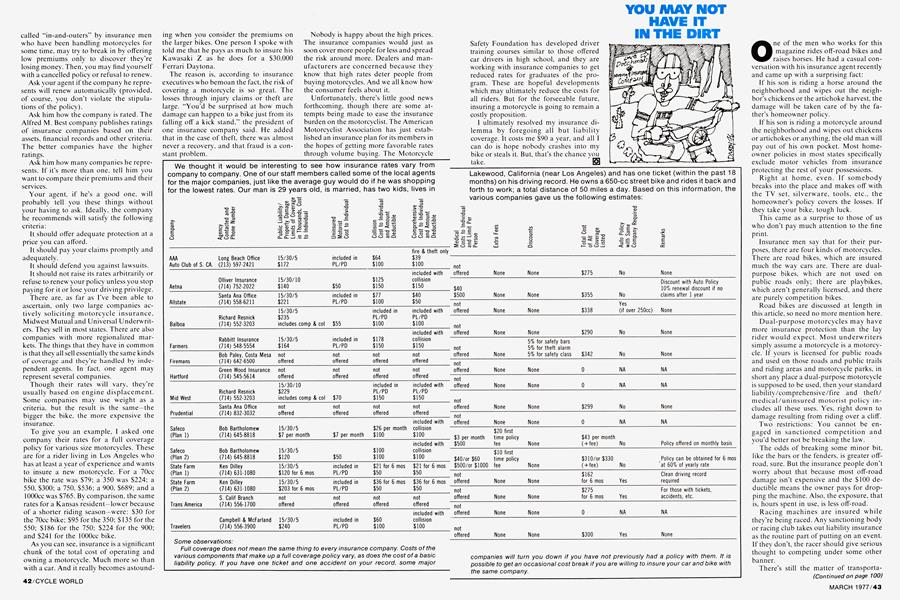

Road bikes are discussed at length in this article, so need no more mention here.

Dual-purpose motorcycles may have more insurance protection than the lay rider would expect. Most underwriters simply assume a motorcycle is a motorcycle. If yours is licensed for public roads and used on those roads and public trails and riding areas and motorcycle parks, in short any place a dual-purpose motorcycle is supposed to be used, then your standard liability /comprehensive/fire and theft/ medical/uninsured motorist policy includes all these uses. Yes, right down to damage resulting from riding over a cliff.

Two restrictions: You cannot be engaged in sanctioned competition and you’d better not be breaking the law.

The odds of breaking some minor bit, like the bars or the fenders, is greater offroad, sure. But the insurance people don’t worry about that because most off-road damage isn’t expensive and the $100 deductible means the owner pays for dropping the machine. Also, the exposure, that is, hours spent in use, is less off-road.

Racing machines are insured while they’re being raced. Any sanctioning body or racing club takes out liability insurance as the routine part of putting on an event. If they don’t, the racer should give serious thought to competing under some other banner.

There’s still the matter of transportation. Your motorcycle isn’t considered household property. The organizers are only liable for what happens on the track.

(Continued on page 100)

Continued from page 43

Things can go wrong away from the track. Motorcycles get stolen. They fall off trailers or out of trucks. The owner is liable, that is, if your speedway bike cartwheels into the path of some helpless motorist, it comes back to you.

What the insurance companies do, in a sense, is take your money in exchange for taking your risks. It follows that there will be a way to insure your competition bike off the track and there is, by extending your homeowner’s policy or extending your car insurance to cover everything being towed or stowed or hauled. All it takes is money. But you’ll have to ask the agent. He won’t offer.

The playbike is something of a special case. The underwriters really don’t care what a motorcycle is used for. All they want to know is how big the engine is and the age of the rider. You can get the full car-style insurance policy for your KTM 250 or Pll Norton as for your Honda CB360.

That’s nice, because even when you’re playing, you can bash the machine. More important, you can be involved in a crash and get sued and lose. Only fair. If you’re putting down the trail and I come over the crest and T-bone you, you’ll expect me to pay for your broken leg, just as you would if the same thing happened on the highway.

The drawback to buying a standard cartype policy for your off-road motorcycle is that you pay for more protection than you need. The chances of the insurer paying a claim are less, and the claim will usually be for a smaller amount.

We enthusiasts don’t think about this often. We’re reinforced some, because paying for complete insurance coverage 365 days a year, and paying for protection out there on the road where it’s much more risky than in the dirt, seems a bit much.

There is a way out. It’s a product of our leisure age. We bikers are joined in this by the 4-wheel play drivers, with Jeeps and sand buggies and dune buggies and such. We need some insurance but not as much as we’d have if the vehicle was in daily use.

The insurance companies are not dumb. They have noted this need and have no doubt also noted that because the cost/ benefit ratio wasn’t on our side, we didn’t have insurance. That can cost them and us money.

They have come up with a new touch. It’s called RV insurance and it does what you’d expect. The policy provides liability and property damage coverage for whatever kind of recreational vehicle you have. Because the exposure time is low, and because the cost of repairing off-road accidents is also lower than for road crashes, the prices are lower.

View Full Issue

View Full Issue

More From This Issue

-

Departments

DepartmentsRound Up

March 1977 -

Letters

LettersLetters

March 1977 -

Departments

DepartmentsFeed Back

March 1977 -

Technical

TechnicalBolt-On Power And Handling For the Yamaha Tt500

March 1977 By Bob Atkinson -

Features

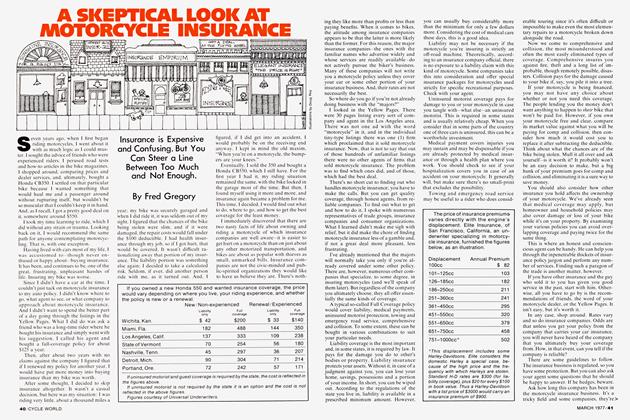

FeaturesA Skeptical Look At Motorcycle Insurance

March 1977 By Fred Gregory -

Product Evaluation

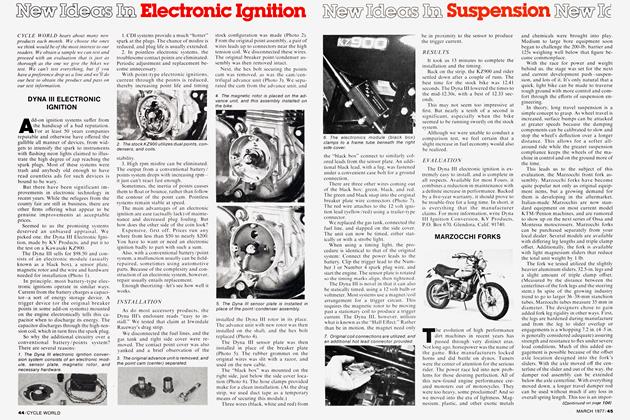

Product EvaluationNew Ideas In Electronic Ignition Suspension

March 1977