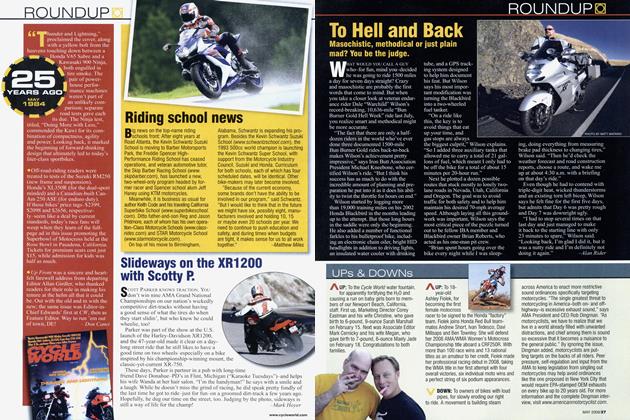

Belt-tightening

Harley-Davidsion, like most of file industry, is making adjustments to weather the storm

Harley-Davidson announced that it would cut 1100 jobs during 2009 and 2010. This is just over 10 percent of the workforce. The Motor Company will also consolidate its two Milwaukee engine and transmission plants to a new location in Menomonee Falls and switch product transportation to outside contractors. “We have a strong core business anchored by a uniquely powerful brand, but we are certainly not immune to the current economic conditions,” said Jim Ziemer, Harley-Davidson’s CEO.

These are normal and sensible responses to the present contraction of consumer spending. It has been revealed that the company’s net income fell 30 percent in the past year, and that product shipments will drop 10 to 13 percent in 2009. “We reduced our production levels prudently in 2008, helping our dealers achieve lower inventory levels,” said Ziemer, “and we’re going to show similar discipline in 2009.”

In the language of business, H-D will take a one-time charge of $110 to 140 million in these changes, which are expected to yield $60 to 70 million in annual savings.

As others in the motor-vehicle trade have reported sales drops of up to 49 percent (GM), H-D’s 10-13-percent contraction is moderate. The company’s carefully cultivated brand loyalty is

a strong asset in times like these.

Harley’s continuing concern in good economic times or bad is to “reach out to younger and diverse riders.” The bulk of H-D’s business is sales of its traditional air-cooled Big Twins. Those machines attract many older riders who cannot be considered a continuing market.

Cadillac, facing a similar problem, chose to meet European and Japanese luxury car competition squarely, with high-technology engines and morecapable vehicles. This expanded its market to younger buyers. Harley’s stylish V-Rod liquid-cooled Twin and sporty Buell line are aimed at similar goals, as would the possibility of a new V-Four engine platform (see story at left). How can a company create a successor for an iconic product? What would a 2009 update of Winchester’s classic Model 1894 lever-action rifle look like? Would it even be possible to imagine a 2009 Duesenberg?

Harley-Davidson is valued and taken seriously by the financial community, as revealed by the recent purchase of $300 million in Harley “senior unsecured notes” by billionaire businessman Warren Buffett’s Berkshire Hathaway Inc. These notes were offered to raise funds for HarleyDavidson Financial Services to help create liquidity for its lending activities. In these times, that’s solid confidence.

Kevin Cameron