THE GOLDEN CAGE

UP FRONT

EDITOR’S LETTER

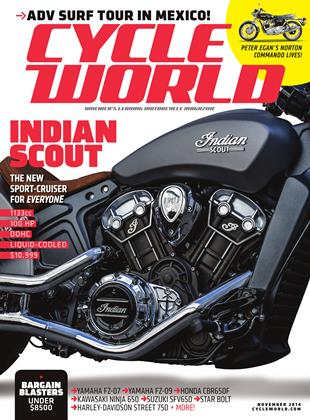

INDIAN UNCHAINS ITSELF

The motorcycle market has been addicted to the baby boomer since he was able to afford a motorcycle. And the boomer has been addicted to the motorcycle market. It’s been a good relationship.

Depending on who you talk to in the motorcycle industry, we have something like 15 to 20 more years of big numbers of boomers peeling large green for the expensive and tech-rich motorcycles.

The youngest boomers are turning 50 about now, so they remain a force.

This is why Indian needed to start with the Chief. Its name, its look, and its performance all hit the boomer squarely in the heart.

But this is one of the things that makes the Scout so interesting as a follow-up.

It’s like a Harley-Davidson V-Rod meets Sportster meets a touch of XR1200. Boomers will like the Scout, but it’s also a model that looks way ahead.

If you’d asked me five years ago about Harley-Davidson’s future, I would have said the company had built a golden cage for itself, so powerfully, almost too powerfully, marketing itself to what it calls the “core customer,” who also happens to have been a boomer. But Harley has poured massive effort into other demographics, with large rewards. The company stated in 2013 that six of 10 models globally were sold to “outreach” customers. One of the segments it works hardest on is “young adult,” or 18to 34-year-olds. And they have bought a lot of bikes, these younger folks doing their part to help make Harley-Davidson a roughly $4-billion-a-year company that expects to ship about 260,000 motorcycles in 2014.

Indian’s parent company, Polaris, is also a $4-billion-a-year company, its largest portion of revenue coming from Ranger ATVs and RZR side-by-sides, which, according to Polaris’ secondquarter financial report, is about seven times larger than motorcycles.

Unlike Harley, Polaris doesn’t share motorcycle production numbers, but according to the July press release, motorcycle sales appear to have gone up 107 percent, thanks to the introduction and relatively rapid acceptance of Indians to the marketplace. After 16 years of working on Victory, in one year Indian sales (in dollars, if perhaps not in total units) appear to have equaled or surpassed Polaris’ original motorcycle startup. That’s brand power, yes, but it would be foolish to ignore the positive influence of beautifully executed styling and excellent engineering that the Chief models carried to market.

Harley-Davidson certainly won’t be shaking in its boots. It shipped more than 36,000 Touring models in the first three months of 2014, the Street Glide Special the likely leader as it was the largest-selling Harley model in 2013. I’d guess the Street Glide alone probably sells in larger numbers than the Victory and Indian model lines combined.

Polaris is trying to scale a big mountain.

But if the Scout is an indication of the willingness to venture down paths other than the traditional, big American air-cooled V-twin cruiser, it appears fully prepared to try to make the climb.

Overall, the Scout isn’t that different than other cruisers before it, but Indian hit a magic combination of elements.

The Scout rides like what you might describe as a “low” standard (no jokes). That is, it’s agile, light feeling, and quick, while carrying itself very much like an American-style cruiser. It’s also comfortable for a wide variety of riders, and it feels good to ride.

Indian is a small manufacturer, but it’s got a brand, it’s got engineering, and it’s got a strong parent company willing to invest in good ideas. The Scout is one of them. What’s next?

MARK HOYER

EDITOR-IN-CHIEF

THIS MONTH'S STATS

12

PHOTO FRAMES OF MARC MARQUEZ'S AMAZING SAVE

two

SURFBOARDS THAT SUR VIVED A TRIP TO MEXICO ON THE SIDE OF AN ADV BIKE

21

KILLER MIDDLEWEIGHT DEALS

View Full Issue

View Full Issue

More From This Issue

-

Intake

IntakeIntake

November 2014 -

Ignition

IgnitionBattery Basics

November 2014 By Kevin Cameron -

Ignition

IgnitionThe Kinetic Art of Marc Marquez

November 2014 By Milagro, Tino Martino -

Ignition

IgnitionCw 25 Years Ago November 1989

November 2014 By Mark Hoyer -

Ignition

IgnitionSidi Insider Shoe

November 2014 -

Ignition

IgnitionPut It Where the Sun Don't Shine!

November 2014