DONE DEAL FOR DUCATI

AFTER EIGHT MONTHS OF hunting for an outside investor to prop up its precarious cash flow, Cagiva has finally found a partner. In a July 26th deal brokered by Londonbased merchant bank Morgan Grenfell (nowadays part of the giant German Deutsche Bank), an American investment house known as the Texas Pacific Group (TPG) agreed to pay $325 million for a 49-percent holding in a new company called Ducati Motorcycles SpA. This will entail splitting Ducati off from the other marques in the Cagiva motorcycle empire (Cagiva, Husqvama, Moto Morini and MV Agusta), and completely restructuring its day-to-day operation, which will be independent of the remaining 28 companies in the Cagiva Group.

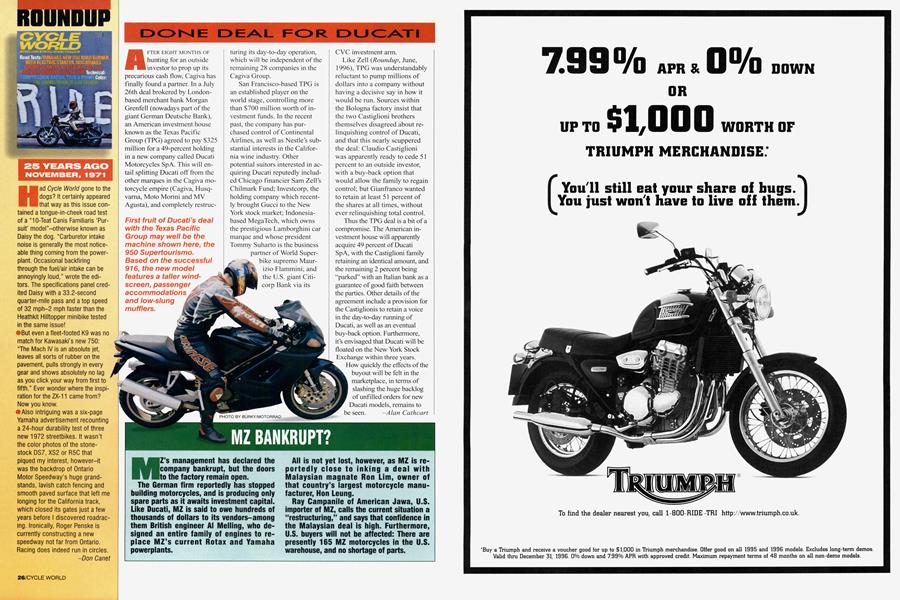

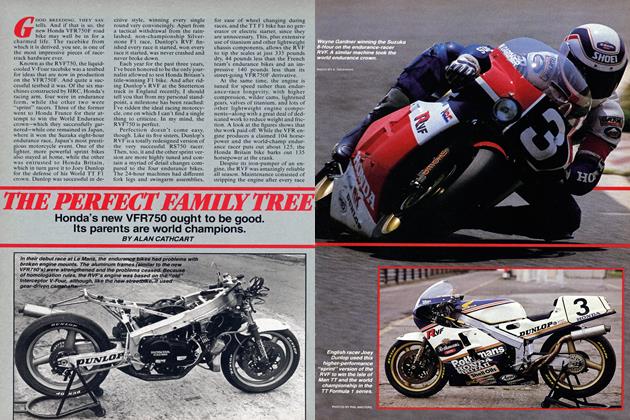

First fruit of Ducati’s deal with the Texas Pacific Group may well be the machine shown here, the 950 Supertourismo. Based on the successful 916, the new model features a taller windscreen, passenger accommodations and low-slung mufflers.

San Francisco-based TPG is an established player on the world stage, controlling more than $700 million worth of investment funds. In the recent past, the company has purchased control of Continental Airlines, as well as Nestle’s substantial interests in the California wine industry. Other potential suitors interested in acquiring Ducati reputedly included Chicago financier Sam Zell’s Chilmark Fund; Investcorp, the holding company which recently brought Gucci to the New York stock market; Indonesiabased MegaTech, which owns the prestigious Lamborghini car marque and whose president Tommy Suharto is the business partner of World Superbike supremo Maurizio Flammini; and the U.S. giant Citicorp Bank via its

CVC investment arm.

Like Zell (Roundup, June, 1996), TPG was understandably reluctant to pump millions of dollars into a company without having a decisive say in how it would be run. Sources within the Bologna factory insist that the two Castiglioni brothers themselves disagreed about relinquishing control of Ducati, and that this nearly scuppered the deal: Claudio Castiglioni was apparently ready to cede 51 percent to an outside investor, with a buy-back option that would allow the family to regain control; but Gianfranco wanted to retain at least 51 percent of the shares at all times, without ever relinquishing total control.

Thus the TPG deal is a bit of a compromise. The American investment house will apparently acquire 49 percent of Ducati SpA, with the Castiglioni family retaining an identical amount, and the remaining 2 percent being “parked” with an Italian bank as a guarantee of good faith between the parties. Other details of the agreement include a provision for the Castiglionis to retain a voice in the day-to-day running of Ducati, as well as an eventual buy-back option. Furthermore, it’s envisaged that Ducati will be floated on the New York Stock Exchange within three years. Flow quickly the effects of the buyout will be felt in the marketplace, in terms of slashing the huge backlog of unfilled orders for new Ducati models, remains to be seen. Alan Cathcart

View Full Issue

View Full Issue