Yen and the art of motorcycle marketing

ROUNDUP

STEVE ANDERSON

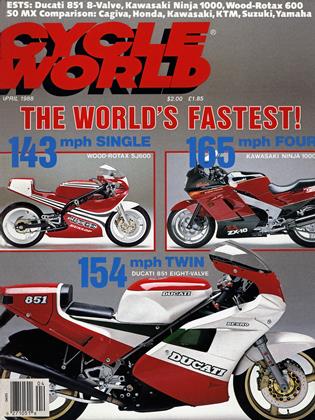

EN-DAKA. THAT’S THE JAPANESE TERM THAT DESCRIBES the present crazy situation with currency exchange rates. En-daka simply means “high yen”; but for us, what it really translates into is expensive motorcycles.

Of course, it’s not so much that the yen is high; rather, the U.S. dollar is low. At its peak almost four years ago, a single dollar could be traded for more than 3 German marks, or 2000 Italian lira, or 240 Japanese yen. Now that same dollar purchases only 1.6 marks, 1200 lira, 125 yen. Importing a product into the U.S. from Germany, Italy or Japan costs almost twice as much now as in early 1984.

Economists and politicians are busily explaining to each other the causes of this situation, and pointing fingers of blame. But to us as motorcyclists, the causes aren’t that important. What’s important is that, with the exception of Harley-Davidsons, new motorcycles have increased in price faster than almost anything else.

It’s not hard to find examples. Honda’s first Shadow 750, when released in 1983, sold for $2998; the 1988 version, the Shadow 800, retails for $4598. In 1983, a top-of-the-line 750 sportbike sold for about $3500; now, a comparable machine is over $5000. When Cagiva first planned the Ducati Paso three years ago, its scheduled U.S. price was $4800; this year, a Paso will set you back $6695. And in each of these cases, the more expensive motorcycle brings its company less profit now than did its cheaper predecessor then.

The effects on the motorcycle industry have been, and still are, major. Sales are down. All of the Japanese companies are tightening their belts, reducing staff and expenditures. Money for such frivolties as advertising and racing has been sharply reduced. As prices rise, the less-expensive models in the lineups get more promotional emphasis. Indeed, en-daka is more responsible for the recent upturn of under-600cc models than is any industry effort to garner new riders.

But for some people, at least, there’s some silver in this dark cloud. Right now, Harley-Davidson can’t produce enough motorcycles. Not only are competing bikes in the U.S. more expensive, but Harley-Davidsons sold in highcurrency countries are cheaper. Harley set a company sales record in Japan last year, and will certainly break it this year. And as new bikes in the U.S. have risen in price, so have used bikes. There’s a very good chance that your motorcycle is worth more this year than it was last.

Still, that’s little good news to compensate for sticker shock. The Japanese motorcycle companies are, however, doing their best to improve the situation. They’re sourcing more parts outside Japan, and companies such as Honda, with U.S. manufacturing facilities, are building as many models here as possible. Companies such as Suzuki that do not have North American plants may soon build them. And every new motorcycle is designed with value more firmly in mind than ever before.

For motorcyclists, the final important fact in this situation is that the price picture is unlikely to brighten any time soon. Most economists predict that the dollar’s value will stay depressed, and perhaps even drop further against the yen. If they’re right, motorcycle prices may never be lower than they are now.

If so, if the dollar drops further, the final irony may come to pass: This year of sticker shock will also have been absolutely the best year to buy a new bike.

Matchless revisited, one last time

In the February Roundup, we listed an incorrect contact in the U.S. for Matchless motorcycles. We said that interested parties should get in touch with John Healy at Triumph Motorcycles in Holliston, Massachusetts, but in truth, Healy and his shop have no affiliation with Matchless Motorcycles. Ftd. The Rotax-powered Matchless machines are sold directly to dealers from the factory; anyone interested in purchasing one should contact the factory at: Matchless Motorcycles Ltd., Units 1 and 2, Silverhills Road, Decoy Industrial Estate, Newton Abbot, Devon TQ12 5ND, England; or call 0626 69700.

BMW rumors

In 1983, with the European introduction of the K100 series, BMW announced its non-participation in the performance wars. The 90 horsepower of the K100 was enough for any motorcyclist, BMW said, and would remain enough. But recent hints indicate that BMW is preparing to join the arms race.

Sighted in Munich, with factory test riders aboard, have been turbocharged versions of both the K75 and K100. It’s not known whether these machines are production-bound, but either could boost BMW performance to match or exceed Japanese 750 and Open-bike levels. More certain is a four-valve head for the K100, under development for the last three years, that perhaps might finally emerge at this fall’s Cologne show. If so, expect a four-valve K100 to make at least 100 horsepower, and, with lighter pistons, to vibrate less than its two-valve cousins.

Honda Hawk GT delays

The new Honda Hawk 650 V-Twin should be finding its way into motorcycle dealerships in April. That’s two months behind the original schedule, a delay created by American Honda’s insistence that the bike undergo an injection of added power before entering the U.S.

The problem started with the Hawk’s place in the Japanese domestic market. There, called the “BROS Project 1” (we don’t know what it means, either), the Hawk was intended to compete with Yamaha’s verypopular-in-Japan SRX600 Single. So, the designers gave the Hawk’s V-Twin a slogging, torquey powerband to match that of a big Single. When American Honda’s test riders tried the machine, they complained that the engine was simply boring, and not suitable for a motorcycle with sporting intentions. The answer, after much internal debate, was a complete engine retuning. So while Japan receives Honda’s ultimate sportbike, the RC30, we can take some consolation in receiving the best-performing version of the Hawk.

View Full Issue

View Full Issue