What It All Means, And How To Know What You Need.

August 1 1981 David D. MalletWhat It All Means, and How To Know What You Need.

MOTORCYCLE INSURANCE

David D. Mallet

You've bought a new bike and you've ordered up all the options; better tires and shocks, a fairing tuned exhausts and a luggage rack.

Now it's time for insurance, which isn't an option. First, if you've financed the new machine the bank or the dealer or both won't let a wheel roll until they've protected their investment by requiring you to buy insurance. Even if you paid for the bike in cash, virtually every state requires you to be insured. (Some have another way, in the form of posting a cash bond, but that's more expensive and even more of a hassle.)

Finally, required or not, you need insurance for your own protection.

What you don't need is too much or too little protection, of the wrong kind, from the wrong place, for too much money.

No insurance policy can ever completely insulate a rider from personal liability or isolate him from all risks. What insurance should do is balance risk versus cost, and give the rider the greatest risk protection, considering the rider's circumstances and bank account (present and potential).

Most bikers are laymen when it comes to insurance and all we know, sort of, is that there's liability insurance and there's comprehensive and the bank makes us have them both.

There is, as any insurance agent will be happy to tell you in detail, more to it than that.

Liability

By definition, liability insurance covers you when you're liable, that is, when you are held responsible for damage done to somebody else, in the form of person or property. States set minimum liability insurance limits, those limits being indicated like this: 15/30/5. That means the policy will pay for damages caused by the insured vehicle up to $ 15,000 in injuries to one person, up to $30,000 for combined injuries to more than one person, and up to $5,000 for properly damage, including ¿lamage to somebody else's car or even somebody's house if the insured vehicle ►crashes into it.

The example limits of 15/30/5 are the minimum required for the state of California, and were set more than 10 years ago, before inflation's ravages were well ^known. For another example, Alaska state laws sets a higher minimum, 25/50/10. Unfortunately, some insurance companies do not permit the higher-than-minimum limits on motorcycle policies.

In the typical bike-auto policy, it may be rare for the motorcyclist to cause the policy limits of $5000 (California) or $ 10,000 (Alaska) property damage in an initial colJision. However, if the auto then goes out of control, the motorcyclist may be liable for all ensuing damages.

There is more to liability insurance than a simple dented fender. Motorcyclists tend to believe that because we ride small vehicles we don't have to worry about doing large amounts of damage, to persons or property.

It isn't necessarily so. If, for instance the motorcycle is at fault when it bangs into ^the car that is rebounded into the truck that %lams into the ice cream parlor, the rider is liable for the first, second and third collisions.

In today's world of high medical costs and generous personal injury awards, several hundred thousand dollars is not an uncommon damages figure.

If the damages caused by the insured rider exceed his policy's limits and the insured rider is clearly at fault, the insurnace company may pay “policy limits” and leave the insured holding the bag for the rest if the injured person decides to sue. Looking at it that way, a legal-minimum policy for California pays for the first $15,000/30,000/5,000 worth of damage. Peanuts.

It's best to have much more than the legal liability coverage minimum, at least $50,000/100,000/15,000.

In a typical car insurance policy, passengers are covered in two ways. Any medical expenses from a crash are first paid from the optional medical coverage portion of the policy (if purchased). Then, if the passengers' damages exceed the limits of the medical coverage, any liability is paid out of the normal liability portion of the policy.

Many motorcycle policies, however, do not cover passengers, unless “passenger liability” coverage is purchased at an additional cost. Passenger liability coverage is extremely important for riders who intend to carry passengers. Unfortunately, most policies have the same type of ridiculously low (for example, $25,000) coverage as regular liability policies.

Uninsured Motorist

Uninsured motorist coverage is perhaps the most important (and under-rated) coverage. Few people understand it and many don't buy it in the hopes of saving a few bucks.

Liability insurance is “indirect” insurance, protecting the insured's bank account in regards to liability to third persons. Uninsured motorist coverage directly protects the insured in the event he is injured by an uninsured motorist. It covers personal injury, not property or vehicle damage, in most states.

The reasons for uninsured motorist coverage are not nice. On the one hand, most states require all operators to be insured. On the other, few states bother to enforce the requirements. As a result those of us with salaries, property and reputations to protect are insured. Operators with literally nothing to lose, need not bother.

If an unemployed drunk driving a $200 car on which he owes $500 is so worried about being evicted that he runs into you and breaks your leg, you're hurt and he's liable. Except that he is, as they say in legal circles, judgement proof. There's no point trying to collect because there's nothing to collect. And there are more of these people driving around out there than anybody likes to admit.

Many policies have uninsured motorist limits of $25,000/50,000 (the latter figure to cover the rider and a passenger), these limits being wholly inadequate, particularly considering what usually happens in an auto-bike collision, and who is more likely to sustain severe injury.

Medical

Medical coverage insures a rider for bodily injury when his Kenny Roberts imitation flops and he goes careering into the tules. The $1000 coverage (and $50 deductable) provided by a typical motorcycle policy wouldn't pay for a broken throttle hand. And, as far as value goes, compared to a similar auto policy in the amount of $5000, the motorcycle premium costs 23 times as much on a dollarfor-coverage basis.

Comprehensive

Comprehensive covers any property damage to a bike not arising from a collision, including the thing about which most riders have a justified paranoia—theft.

Comprehensive can be classified as a high-risk/small-loss type of coverage. The chances of the bike being stolen are probably greater than the risk of being liable for personal injuries. On the other hand, the actual dollar loss is ordinarily quite a bit lower.

Let's assume that a bike covered by a comprehensive policy with $200 deductable cost $4200 out-the-door with aftermarket tires and shocks, a sport fairing, tuned exhaust system, and an oil cooler. Let's also say that the bike is stolen a year after it is purchased. The approximate fair market value of the motorcycle would be about $1800, although the rider can always haggle with the insurance adjustor if the offered payment is too low. The deductable is subtracted, netting the rider $1600, and since he paid, say, $162 premium, the actual recovery is only $1438. After two years, the net recovery figure would be around $915. It is better to recover $1438 or $925 than nothing. But what is the actual risk that a rider will lose a bike every year or two?

For some motorcyclists, comprehensive may be a good value or a requirement for getting financed. For others it is a waste of money. The owner of a new machine, subject to the normal-if-distressing depreciation such bikes undergo, may decide that theft protection comes cheaper if instead he uses the first year's premium for a lock, an alarm and a Doberman pinscher. Other motorcycles appreciate. If you have a restored Indian Chief that must be left unattended at times, theft insurance is probably your best protection. (No, money doesn't reimburse you for the emotional loss of a treasured possession, but it's better than mere sympathy.)

Collision

Collision insurance compensates for damage to the insured bike while it is being ridden. If the bike will ever be ridden by another rider, say a riding buddy, it's important to see if the policy covers damages when someone other than the named insured is aboard.

Looking at the factor of reimbursement, two years of collision insurance premiums would net about $700 for a totalled machine that cost $4200 new. The decision of whether or not the coverage is needed depends upon how the bike was purchased (financed or cash) and an assessment of the rider's skill. On a dollarfor-coverage basis, motorcycle collision coverage costs four times as much as equivalent automobile coverage.

In most policies, accessories are not covered under normal comprehensive and collision. Is the extra premium worth it for optional accessory coverage? After one year, $740 worth of accessories will be worth no more than $370. After deducting a typical premium of $75 and the deductable, the rider would net $95 if his bike was stolen after one year. After two years the recovery would be zero.

All the above is based on averages and common practice. Thus, some or part or all or none may apply to you and your bike. An article like this can give the outline and the general information but it can't give detailed advice. Deciding what coverage you need is up to you.

For our typical example, the man who's just bought a big new machine with all options, the ideal coverage would be single-limit liability coverage in the amount of $500,000 and uninsured motorist coverage in the same amount. For the rest, like comprehensive and medical and the like, the rider would act as his own insurer. He'd also have to keep a rein on King Kenny imitations, pay cash for the bike, buy and use locks and alarms, etc., (Unfortunately, insurance companies do not offer such coverage and even resist writing high-limit (100/250/50) liability policies for bikes.)

It also means saving up to $750 or so in annual premiums and it means having the coverage you need when it counts.

For the collector, with an antique or classic that's only ridden in optimum circumstances and then very carefully, comprehensive will protect against theft and vandalism loss. The cafe rider needs liability, uninsured motorist and can skip passenger coverage if one person alone is a tight fit on the skimpy seat.

Dirt riders. . . you hadn't thought about your dirt bike? You're lucky. No, you can't get the usual insurance and you don't need it, but is your motocross monster protected if it's stolen from your garage? Are you sure? Just because it's parked next to your lawn mower doesn't mean it's household goods and is covered by your homeowner's policy. And you don't think the trail rider you may T-bone can sue for injuries? It's happened.

And so it goes with insurance. There isn't one policy that's right for every rider. What you need is good advice, from an agent who knows about bikes and wants your business and can sell you insurance from a company that's going to be there when needed.

How do I go about this? you ask . . .

View Full Issue

View Full Issue

More From This Issue

-

Up Front

Up FrontA Satisfied Mind

August 1981 By Allan Girdler -

Letters

LettersLetters

August 1981 -

Book Review

Book ReviewBrooklands Behind the Scenes

August 1981 By Henry N. Manney III -

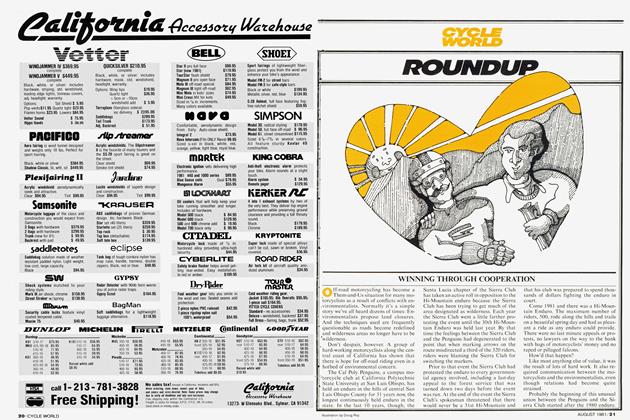

Departments

DepartmentsRoundup

August 1981 -

Motorcycle Insurance

Motorcycle InsuranceNot All Motorcycle Insurance Companies Are Alike. Some Take Your Money And Go Out of Business.

August 1981 By John Ulrich -

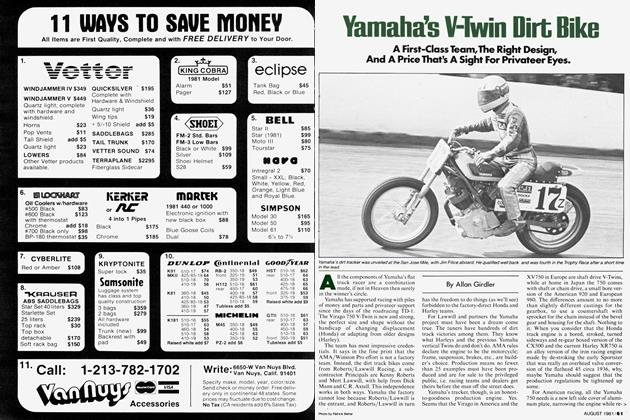

Competition

CompetitionYamaha's V-Twin Dirt Bike

August 1981 By Allan Girdler